CPPCC member: Deepen the cooperation between Guangdong, Hong Kong and Macao in aged care services and build a platform for aged care services in the three places.

CCTV News:On August 22, 2019, Foreign Ministry Spokesperson Geng Shuang held a regular press conference.

Q: It is reported that yesterday, the US government imposed sanctions on three China citizens who illegally smuggled fentanyl into the US. As far as I know, the above three people are currently in China. Will China arrest them?

A: Obviously, you should ask the relevant departments about this question, because what you are asking is whether you will arrest.

What I can tell you is that China and the United States have always maintained cooperation in the field of drug control, and the law enforcement departments of the two countries have also communicated on specific cases. There is no doubt that you have to ask the relevant departments about the specific situation.

For the first time, Chinese and foreign scientists constructed embryos composed of human cells and non-human primate cells, and the experiment ended after these embryos survived in vitro for 19 days.

On April 15th, the top academic journal Cell published online a study jointly completed by the State Key Laboratory of Nonhuman Primate Biomedicine jointly established by the province and the Ministry/Institute of Primate Translational Medicine of Kunming University of Science and Technology and Salk Institute of Biology of the United States. Researchers injected human stem cells into cynomolgus monkey embryos and were able to cultivate chimeric embryos for a long time, providing a new perspective for developmental biology and evolution. At the same time, the study also triggered a wide range of ethical discussions.

The correspondent authors of this study are Professor Juan Carlos Izpisua Belmonte of Salk Institute of Biology in the United States and researcher Wu Jun (now assistant professor of Southwest Medical Center of the University of Texas), Professor Tan Tao, Professor Niu Yuyu and Academician Ji Weizhi of Kunming University of Science and Technology Institute of Primate Translational Medicine.

"Because we can’t carry out certain types of experiments on human bodies, there must be better models to study and understand human biology and diseases more accurately." Izpisua Belmonte said, "An important goal of experimental biology is to develop a model system to study human diseases under living conditions."

The press release of the Primate Translational Medicine Research Institute of Kunming University of Science and Technology wrote that the study answered basic scientific questions such as how heterogeneous chimeric cells interact and how to adjust the differences of development procedures, and provided new ideas for solving the problems of low efficiency of heterogeneous chimerism, which was of guiding significance for organ regeneration research.

Chimera between human cells and macaque cells

The scientific research on interspecific chimera has already begun. In the 1970s, interspecific chimeras of mammals began to appear, which were first produced in rodents and used to study the early development process.

In recent years, heterogeneous chimerism in large animals has also made a series of breakthrough progress. For example, a study published in Cell in January 2017 by Izpisua Belmonte and Wu Jun showed that they realized the chimerism of human stem cells in early embryos of pigs. In December 2019, a study published in Protein & Cell magazine by Academician Zhou Qi, Li Wei and Haitang from the Institute of Zoology, Chinese Academy of Sciences and the Innovation Institute of Stem Cell and Regenerative Medicine, China Academy of Sciences showed that they got the cynomolgus monkey-pig chimera for the first time, creating the world’s first "pig-monkey hybrid" creature and died within one week after birth. In December, 2020, the research published in Cell-Stem Cell by Wu Jun and others also showed that they produced the world’s first chimeric embryo of horse and mouse.

These studies have brought a new direction for the further study of chimera, such as how the evolutionary differences between different species affect each other in chimera, the interaction, communication and competition between cells and so on.

On October 31st, 2019, Tan Tao, Niu Yuyu and Ji Weizhi collaborated with Salk Institute of Biology and Shenzhen Huada Institute of Life Sciences to publish their research results online in Science magazine. The research team realized the culture of cynomolgus monkey embryos in vitro for 20 days, and the cultured embryos showed highly consistent morphological and gene expression characteristics with the embryos developed in vivo.

In this latest study, the researchers first isolated fertilized eggs from monkeys, and after growing them in Petri dishes for 6 days, 132 monkey embryos were injected with human expanded pluripotent stem cells (hEPS), which can grow into different cell types inside and outside the embryos.

Through immunofluorescence research, that is, the antibody binds to the fluorescently labeled stem cells, the research team observed that human stem cells survived, and compared with previous experiments in pig tissues, the relative efficiency of integration was higher. Overall, this study evaluated the chimeric ability of human expanded pluripotent stem cells (hEPS) in cynomolgus monkeys. Izpisua Belmonte said, "Chimeras of human and nonhuman primates are closer to humans than all other species on the evolutionary time axis, which can help us better understand whether evolution imposes barriers on chimera generations and whether we can overcome these barriers."

Scientific research needs and ethical challenges

Why do you want to do this kind of research? Wu Jun said in an interview with reporters that human organ transplantation and exploring the unknown mysteries in developmental biology are in urgent need of such research.

From the perspective of organ transplantation, the World Health Organization (WHO) estimates that the 130,000 organ transplants performed each year only account for 10% of the actual demand, and the available organs are extremely short. Researchers hope that cultivating human cells in pig tissues similar in size, physiology and anatomical structure to human organs can alleviate this problem.

Wu Jun told reporters that human organ transplantation is a very important development of modern medicine. By removing diseased and necrotic organs and replacing them with healthy and energetic organs, patients with life-threatening diseases can be revived.

Wu Jun mentioned at that time, "One of my ideals is to obtain functional and independent human organs through stem cell technology, so as to provide legal and effective organ sources for patients who need organ transplantation. Of course, this is only the ultimate goal. This road still seems to have a long way to go. Our research only opens a door for these futures. More research needs the joint efforts of scientific researchers from all over the world. "

Wu Jun and others had previously integrated human cells into early pig tissues, which marked the first step in producing transplantable human organs from large animals. However, the proportion of human cells is quite low, which may be due to the huge evolutionary distance between the two species (90 million years), so the research team began to study a closer species — — Chimera formation in rhesus monkeys. Izpisua Belmonte said so vividly, "Human cells in pig tissues are similar to cells trying to find common ground between Chinese and French, while human cells in macaques are more like two closely related languages, such as Spanish and French."

Although these chimeras with macaques will not be used for human organ transplantation, they reveal valuable information about how human cells develop and integrate and how cells of different species communicate.

In the long run, researchers not only hope to use chimeras to study early human development and design disease models, but also hope to find new methods to screen new drugs and produce transplantable cells, tissues or organs.

These studies provide a new platform for studying how specific diseases occur. For example, a specific gene that may be related to a certain cancer can be modified in human cells. Then, using these engineering cells to observe the progress of diseases in the chimeric model may show more applicable results than the typical animal model, in which diseases may form different processes.

Chimeric disease models can also be used to test the efficacy of pharmaceutical compounds and obtain results that can better reflect human reactions. Chimera can also provide unique insights for aging research. Izpisua Belmonte said that researchers do not know whether organs are aging at the same speed, or whether one organ drives all other organs to age and acts as the master switch of the aging process. For example, by using chimerism to grow organs of ordinary mice in long-lived species (such as naked moles), scientists can begin to explore which organs may be the key to aging and which signals are involved in their survival. Of course, it can’t be ignored that the review articles published in the same period of Cell and the news articles on the website of Nature all pay attention to the potential ethical considerations of constructing human/non-human primate chimeras.

"In this field, there are more and more reasonable experiments, using the silver beast as the source of organs and tissues." Alfonso Martinez Arias, a developmental biologist in universitat pompeu fabra, Spain, told Nature that experiments with domestic animals such as pigs and cattle are "more promising and will not challenge ethical boundaries". He said, "there is still a complete field of organ-like, and there is hope to get rid of animal research."

Combining human cells with closely related primate embryos also raises questions about the status and identity of chimeras. Insoo Hyun, a bioethicist in case western reserve university, USA, said, "Some people may think that you have created a morally ambiguous entity there." He also said that the research team of this latest study completely followed the existing guidelines. Nature also pointed out that if these human-monkey mixed embryos are implanted into animals, they will eventually develop into some kind of creature or even be born, then the ethical problems they face are obviously much more complicated.

Export-to-domestic sales is a change in business practices, which refers to the fact that under the background of economic crisis, the original export-oriented foreign trade enterprises were compressed by international market consumption, and the pressure on product sales increased. In order to survive, enterprises changed their sales channels from foreign markets to domestic markets, and obtained new channels for commodity sales through domestic sales, so as to seek the survival and development of enterprises, which became a way for enterprises to seek a way out in the crisis.

After spending nearly 160 million pounds to build a lineup, Mourinho’s new season at Manchester United is not a good start. Since Manchester United has not yet found a suitable winning plan, this has also caused Mourinho to suffer many doubts. Among them, the British media and some famous celebrities have discussed more, that is, is Mourinho’s tactics really out of date? To answer this question, we might as well analyze Mourinho’s tactics first.

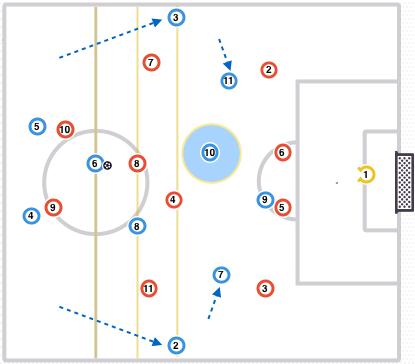

4-2-3-1 formation

Over the past six years, Mourinho has been using the 4-2-3-1 formation. From Inter Milan to Real Madrid, from Chelsea to Manchester United today, Mourinho’s main formation is 4-2-3-1. This is a relatively young formation, which only became popular at the beginning of this century, and Mu Shuai has become a die-hard fan of it. This formation consists of 4 defenders, 2 midfielders, 3 attacking midfielders and 1 center. The difference lies in the configuration of midfielders. If two defensive midfielders are deployed, this formation is a defensive formation, otherwise it tends to attack.

4231 formation

Regarding the essence of this formation, Mourinho once famously said: "We have a large number of midfielders (5 people). First of all, start with one of the two midfielders. If he is in an unguarded state, he will have enough time to gain insight into the whole situation. If someone watches closely, it means that there is enough space for the other midfielder. If both of them are stared at to death, it means that the other winger will also retreat to participate in the defense. At this time, the two wingers will open their doors wide and our wingers or full-backs can March in. Therefore, in the face of 442, 4231 will always occupy a certain advantage, a natural advantage. "

4231′ s full-back needs to insert assists and is easy to be hit behind, so the winger has to assist in defense.

Specifically, the 4-2-3-1 tactic has two core advantages. First, it can form a triangular position on the field. In football match, the penetration success rate of triangle pass is more effective than that of straight pass, and triangle attack is the essence of 4-2-3-1. After the close connection between the two midfielders and the three attacking midfielders, it can not only ensure the team’s penetration ability, but also ensure the team’s midfield control. In addition, the attack of 4-2-3-1 formation is very flexible, and three attacking midfielders and one striker can form a variety of attack modes. The most important thing is that the counterattack of this formation is very sharp, and the team can quickly push the ball into the opponent’s restricted area to form a blow after breaking the ball. There are countless such cases in the team that Mu Shuai coached in the past.

Jose Mourinho’s 4231 in Real Madrid’s last season

Of course, there are no perfect tactics in football matches, and 4-2-3-1 tactics also have their natural weaknesses. First, the wing defense of this formation is weak, because it is a double-waist configuration, they need to focus on the middle, so when the full-back assists, the team’s wing is likely to be penetrated. Second, the three attacking midfielders have both offensive and defensive functions. Because of the single striker configuration, the three attacking midfielders need to put a lot of energy into the offense. At the same time, because the team’s wing defense is weak, the team’s winger has to return to defense. In this case, the winger will be relatively tired and easily arouse their dissatisfaction with the head coach.

4231 tactics is still one of the most widely used tactics.

Generally speaking, the 4-2-3-1 tactic is one of the two or three most popular formations in today’s football, and it is also one of the alternative tactics that must be considered in the coaching staff of each team. Statistics show that this formation was the most used tactic in the Premier League, La Liga, Bundesliga and the 2016 European Cup in the past season. After Mourinho used this formation, he won important titles such as Serie A and Champions League in Inter Milan, La Liga in Real Madrid and Premier League in Chelsea for the second time. Therefore, it is obviously unscientific to say that a set of tactics that have been used so widely and achieved endless glory is outdated.

Is Mourinho’s 4-2-3-1 outdated?

As for Mourinho’s tactical problems now, it is a bit one-sided to simply say whether it is out of date or not. However, it should not be ignored that Mourinho also has some problems when using 4-2-3-1 tactics. At present, public opinion has reached a consensus on two points. One is that the personnel used by Mourinho are relatively fixed. No matter during Inter Milan, Real Madrid, or after returning to Chelsea, Mourinho prefers to use a lineup to conquer the world. In short, Mourinho’s main players are very fixed, lacking rotation, and the division of labor of each player is very clear, which can almost be regarded as a quantitative. In the 2014/2015 season, for example, 10 players from Chelsea started more than 26 games in the Premier League.

Jose Mourinho Chelsea version 4231, with fixed personnel and clear division of labor.

In the modern football environment, the employment and division of labor are fixed, which is easy for opponents to guess. In this case, they can play well in a single season, but it is very difficult to play well in a row. After all, when the team’s weaknesses are understood, it is difficult for the team to be as overwhelming as it used to be. Here is a comparison. Guardiola is known as a tactical master. One of the reasons why many people admire him is that his tactics are flexible and changeable. During his time at Bayern, he didn’t have the same starting lineup as the last game for 99 consecutive games.

In addition to fixed personnel, Mourinho also lacks alternative tactics. In the past six years, Mourinho has almost always played in the 4-2-3-1 formation. He has never played in other formations for many times in a row. Lack of innovation and innovation is undoubtedly a taboo in today’s increasingly fierce and refined football competition. After all, a set of tactical designs that were originally sophisticated and advanced will be stripped of their cocoons under the unremitting research of one opponent after another, thus finding out the loopholes. At this time, if there is no innovation, then the team’s combat power will undoubtedly be seriously affected.

Sampaoli, former coach of Chile’s national team, said: "Ferguson has always been brilliant because he is always changing. He won the Champions League with a 4-4-2 formation in 1999, then he changed it to 4-4-1-1, and then he won the Champions League with a 4-3-3 tactic. Finally, in 2013, he won his 13th Premier League trophy with 4-4-2 tactics. " Michael Owen, the former Mr. Golden Ball, once said: "The times are developing and the football is changing. If I put it today, I may not be a top player." It can be seen that the once brilliant ones may not be able to adapt to the latest football environment.

tag

Today, the 4-2-3-1 tactic is still widely used. It is obviously unscientific to say that this tactic is outdated. However, under this tactical framework, Mourinho’s fixed selection of personnel and details (changing the defensive back to the defensive back when defending, coordinating the defensive back with the defensive back when balancing, requiring the winger to return to the defense, etc.) and the lack of tactics also limited the combat effectiveness of his team to some extent. Now, perhaps Mourinho really needs to ponder Manchester United’s alternative tactics, or inject more fresh elements into the existing tactics. Now it’s not just Manchester United that needs to change. Mourinho, like the Red Devils, has reached the crossroads of falling or re-rising. We will wait and see what kind of answer Mu Shuai will give.

A week ago, at the auto show, the latest model ES9 and Trumpchi ES9 were exhibited, and the new car was a plug-in hybrid.

In terms of appearance, the design of the GS8 is continued, but the details are very different. The ES9 uses a large-sized midnet, which makes the entire front face look very domineering. The headlights are the same as those of the GS8.

The front surround features chrome-plated trim, and the rear of the vehicle is identical to the GS8, featuring classic taillights.

In terms of body size, the length, width and height of the new car are 5115 (4980)/1950/1780mm, and the wheelbase is 2920mm.

Qi ES9 traveler offers another front face style, in which the net also adopts a new design, and adopts the GAC logo, and uses a thick chrome decoration, the front bumper has also been redesigned, and the new car also adopts a unique style of wheels.

At the rear of the vehicle, the new car uses the design of a small schoolbag, which also applies to the GAC logo. Since the license plate is moved down everywhere, the bumper has also been redesigned, making it appear more exaggerated.

In terms of power, both the Trumpchi ES9 and the Trumpchi ES9 Traveler are equipped with 2.0L Trumpchi, with a maximum power of 140 kW, a plug-in hybrid system, and a maximum speed of 180km/h.

At the turn of spring and summer, the number of patients with atopic dermatitis is gradually increasing, and the itching of the skin is unbearable, which seriously affects the quality of sleep and life. To control itching and remove skin lesions quickly and meet the most urgent treatment needs of patients, systematic treatment scheme and standardized whole course management are urgently needed. Recently, well-known experts in the field of dermatology in China, such as Professor Xing Hua from the First Affiliated Hospital of China Medical University, Professor Wang Gang from Xijing Dermatology Hospital of the Fourth Military Medical University, Professor Zhang Xuejun from the Institute of Dermatology of Fudan University, and Professor Yao Zhirong from Xinhua Hospital affiliated to Shanghai Jiaotong University School of Medicine, gathered at the first dermatology summit forum, and were interviewed by the media on the status quo, development and reform of atopic dermatitis treatment.

Atopic dermatitis ≠ Eczema walks out of the cognitive misunderstanding of AD.

Atopic dermatitis

Dermatitis (referred to as "AD" for short), known as the "No.1 disease" in dermatology, is a systemic immune disease caused by inflammatory reaction, characterized by chronic recurrent itching and inflammatory lesions, and may also be accompanied by allergic rhinitis, asthma, allergic conjunctivitis, urticaria and other allergy-related diseases. With the continuous development of society and the change of living habits, the number of patients with atopic dermatitis is increasing day by day, and it has become the first skin disease among non-fatal diseases.

Is atopic dermatitis what we often call "eczema"? In this regard, Professor Zhang Xuejun from the Department of Dermatology of the First Affiliated Hospital of Anhui Medical University said that most eczema is atopic dermatitis. Both of them have clinical characteristics such as dry skin, itching and rash, which are mostly found in limbs, elbow fossa and joints. Eczema is divided into acute, subacute and chronic. In the acute stage, it is flaky, with erosion, exudation and wet surface. When the treatment effect is not good, it may lead to the increase of IGG and eosinophils in the body, which will turn into subacute or chronic, and the rash will be lichenized and stubborn. If patients have allergic dermatitis, rhinitis, asthma or parents have a family history of stubborn recurrent eczema, they can usually be diagnosed as atopic dermatitis.

Relieve "skin anxiety" AD screen diagnosis and treatment tube ushered in a breakthrough

"With the establishment of diagnostic criteria for atopic dermatitis in China, the diagnostic rate of the disease has increased significantly." Professor Yao Zhirong from the Department of Dermatology, Xinhua Hospital, School of Medicine, Shanghai Jiaotong University, said that epidemiological investigation showed that the prevalence of atopic dermatitis in infants under one year old reached 30.48%. 1 year old — The incidence rate of 7-year-old is 12.94%, and then there is a downward trend with the increase of age. The prevalence rate of adults is usually 2%-mdash; 5%, and the incidence tends to increase in the old age. In recent years, "Atopic Dermatitis Research Center" of the Dermatology and Venereology Branch of Chinese Medical Association has focused on AD treatment, gone deep into the grass-roots units, collected patient data, carried out epidemiological investigation, and distinguished children from infants and children, thus creating the diagnostic standard of atopic dermatitis for infants and children in China internationally. Strive to keep pace with the international standard in standardized diagnosis and treatment, and create a new method for treating intractable atopic dermatitis by vein occlusion, and the related mechanism research has been recognized by international academic circles.

Digging deep into the pain points of diagnosis and treatment and promoting the establishment of standard outpatient service in AD specialty

In view of the pain points and difficulties in the treatment of atopic dermatitis, such as irregular medication, poor compliance and unsatisfactory disease control, how to realize scientific treatment? Professor Wang Gang of Xijing Hospital of the Fourth Military Medical University put forward: First, for severe patients with atopic dermatitis, the key point of treatment is to quickly relieve itching and other prominent symptoms. If there is no practical treatment effect, patients are likely to go to hospital in a hurry and turn to various instant remedies, which will do harm to their health. Second, because of genetic and allergic factors, we can’t completely eradicate atopic dermatitis at present, which needs long-term control. In this regard, the goal of dermatological treatment for AD is to reduce the incidence through effective measures and maintain the condition in a state that basically does not affect the quality of life for a long time. Third, promote the standardization of the whole process management of atopic dermatitis treatment. The more refractory atopic dermatitis is, the more methods there are, and the more "magic doctors" there are. At present, the direction of dermatological efforts in China is to gradually improve the level of standardized diagnosis and treatment. By establishing an outpatient clinic for atopic dermatitis, formulating targeted diagnosis and treatment guidelines and expert consensus, we can set a standardized diagnosis and treatment path for atopic dermatitis diagnosis and treatment and long-term consolidation, so that doctors can manage patients according to the norms.

Focusing on the "long-standing problem" in dermatology, China puts forward the innovative treatment goal of "standard treatment" for AD.

"treat to"

The concept of target (T2T) is widely used in the fields of chronic diseases such as diabetes, hypertension and hyperlipidemia. For atopic dermatitis, control the early symptoms as soon as possible and remove the rash; At the same time, maintaining the state of disease clearance or skin clearance, thus improving the quality of life of patients, which is the core of standard treatment. Professor Xing Hua from the First Affiliated Hospital of China Medical University pointed out that the proposal of "standard treatment" is determined by the nature of the disease. There are quite a high proportion of patients with long-term chronic diseases in AD, so the dosage of medication should be adjusted according to the condition. Therefore, it is necessary to collect the collective opinions of national experts in the field and formulate a consensus report on standard treatment in the continuous research and discovery. Secondly, the concept of AD standard treatment emphasizes patient-centered, fully considers patients’ wishes and pays attention to doctor-patient communication. From the perspective of patients’ actual situation and individual needs, combined with the characteristics of the disease, according to the experience of experts at home and abroad, the patient’s condition is evaluated, the treatment goal is set considering the dynamic change of the condition, and the diagnosis and treatment plan is adjusted according to different people and time. For how to evaluate the recurrence and long-term remission of AD, the previous clinical trials have been facing great challenges in determining the methodology. Generally speaking, "standard treatment" not only has regular disease management, but also fully considers the individual needs of patients. It uses various tools to collect and quantitatively evaluate the information of patients’ illness and treatment, thus standardizing the operation mode of managing patients.

Promoting "standard treatment" in many ways and building a new era of standardized diagnosis and treatment of AD in an all-round way

The incidence of atopic dermatitis is high, and there are many misunderstandings among the people. Traditional therapy is ineffective in long-term disease control. To improve the level of prevention and treatment of AD, and jointly promote the capacity building of AD specialists and the standardized diagnosis and treatment level of AD, it needs the efforts of the government, medical institutions, societies, enterprises, non-profit organizations and other parties. In this regard, Professor Yao Zhirong called for the formation of a consensus in the field of experts to promote the standardized diagnosis and treatment of AD at this stage, and to unify opinions and opinions, textbook compilation, training methods and screening channels. The mainstream media should also speak scientifically and publicize the correct concept of popular science to the public by using credibility and communication power. Professor Gao Xinghua emphasized that China has a large population base and uneven distribution of medical resources. Compared with county and township hospitals, the top three hospitals are exposed to the cutting-edge treatment concepts, practical operations and pharmaceutical products in the medical field more quickly. They should dare to undertake industry responsibilities, extensively carry out online and offline academic exchanges and clinical case sharing, and combine the new concept of up-to-standard treatment, strengthen disease science education and improve the accessibility of innovative drugs. In addition, the government should also call for paying attention to skin health, moving forward to prevent problems before they happen, and give more guidance and support to the health industry and the skin field from the policy level, so that innovative treatments can really play a role and help more patients benefit.

Enter [China News] > >

CCTV News (China News): With the opening of the preview of Beijing Hanhai Art Auction yesterday afternoon, the autumn auction of domestic art in 2009 officially kicked off. More than 2,700 rare lots exhibited this time attracted many collectors and art lovers from all over the country.

Yesterday was the first day of the three-day preview. Before the organizer’s venue was fully arranged, many impatient visitors entered the venue. Especially in the exhibition halls of jade, porcelain, ancient paintings and paintings, the number of visitors was unexpected even by the organizers.

As this auction was held by Hanhai to celebrate the 15th anniversary of its founding, the lots collected from home and abroad highlighted "all categories" and "classic values", and 22 specials were held, covering modern and contemporary, ancient calligraphy and painting, fan painting, couplets of calligraphy books, rare books of ancient books, contemporary ink and wash, national stone crafts, oil painting sculptures, jade articles, gold and bronze statues, Qing dynasty furniture, Ming and Qing dynasties. And some rare works of art that are highly collectible and rarely meet the public also appeared in the preview. Known as the "ancestor of regular script", the original stone "Declaration Table", the landscape painting by Ma Yuan, a famous painter in the Song Dynasty, the statue of bronze Buddha belonging to the collection level, and the oil painting "The Flutter" by the late painter Chen Yifei, who is known as the king of realistic painting in China, have attracted many visitors’ attention.

And these people are not just visiting and studying. They are authentic collectors. You can see that they are holding small flashlights and looking at these pieces of Ming and Qing porcelain carefully. The reporter noticed that the lot they are concerned about is valued at several million yuan. The man has stopped in front of this ancient painting for a long time.

In the crowd, the reporter also found that Chen Danqing, a famous painter, and Cai Mingchao, a collector who bid for the bronze head of Yuanmingyuan at Christie’s auction in February this year, also appeared at the auction preview site. They are interested in porcelain, jade and gold and copper statues.

Related links:

Editor: Liu Yi

Special topic: Wenchuan earthquake in Sichuan

|

Qiu Guanghua, the captain, is the first generation of minority pilots in China Army. He is 51 years old. He is the oldest and most experienced special pilot in the Army Aviation Corps. He has flown safely for more than 5,800 hours.

|

Wang Huaiyuan is the best aerial mechanic in the regiment. Everyone likes to fly with him. Not long ago, he promised to take his brother with a disabled leg to Chengdu for treatment after the disaster relief mission was completed.

|

Chen Lin’s daughter just finished her first birthday, but she couldn’t send a cake on her first birthday because she participated in the disaster relief.

|

Li Yue just got married during the Spring Festival this year, and her newly-married lover is waiting for his safe message every day during the disaster relief.

|

Sergeant Zhang Peng submitted an application for joining the Party during the disaster relief period. Before the mission, he called his mother to tell his family not to worry about him.

CCTV News: The first report meeting of the report group on heroic deeds of earthquake relief was held in the Great Hall of the People at 9: 30 this morning. In his report, Zhang Xiaofeng, political commissar of an aviation regiment in Chengdu Military Region, introduced the whole process of the helicopter crash driven by Qiu Guanghua. Zhang Xiaofeng revealed that Qiu Guanghua was supposed to be in charge of the ground command in this disaster relief, but he took the initiative to take part in the flight, and it was only half a year before he was grounded.

Zhang Xiaofeng introduced that the air route from Chengdu to Lixian was called "death route" by pilots. On this route, although we saved the day again and again and turned the "death route" into a "life channel", unfortunately it still happened. On the afternoon of May 31, Qiu Guanghua’s unit was ordered to transport health and epidemic prevention experts to Lixian. On the way back, near Yingxiu, Wenchuan County, I was caught in a low cloud, fog and strong airflow, and unfortunately crashed at 14: 56. Captain Qiu Guanghua, co-pilot Li Yue, mechanics Wang Huaiyuan, Chen Lin, petty officer Zhang Peng and 14 passengers are missing.

Zhang Xiaofeng said that Qiu Guanghua’s crew had made two flights that morning. Considering that famous experts were being transported, the regiment decided that Qiu Guanghua’s crew would carry out this mission. At that time, it was lunch time. Qiu Guanghua and the crew ate two meals in a hurry and flew to Lixian. This is their 64th disaster relief mission. About half an hour after returning from Lixian, the helicopter entered Ginkgo to Yingxiu. The mountains here are high and the valleys are deep. In some places, the gap between the two mountains is less than 300 meters.

Zhang Xiaofeng recalled that in the mountains in the afternoon, the weather changed rapidly. Shortly after the helicopter entered the valley, a large area of thick clouds and dense fog suddenly appeared, which covered the narrow passage. "Don’t move, look at the course!" This is the last sound left by Qiu Guanghua, and then it disappeared from the communication signal and disappeared from the sight of his comrades …

Zhang Xiaofeng said that Captain Qiu Guanghua, a 51-year-old first-generation minority pilot of the China Army, is the oldest and most experienced special pilot of the Army Aviation Corps and has flown safely for more than 5,800 hours. In this disaster relief, the regiment originally arranged for him to be in charge of the ground command, but he took the initiative to fight and insisted on taking part in the flight. At this time, it was only half a year before he was grounded.

Wang Huaiyuan is the best aerial mechanic in the regiment. Everyone likes to fly with him. Not long ago, he promised to take his brother with a disabled leg to Chengdu for treatment after the disaster relief mission was completed. Both Chen Lin and Li Yue are under 30 years old this year. Chen Lin’s daughter just finished her first birthday and couldn’t send a cake on her first birthday because she participated in disaster relief. Li Yue just got married during the Spring Festival this year, and her newly-married lover is waiting for his safe message every day during the disaster relief. Sergeant Zhang Peng submitted an application for joining the Party during the disaster relief period. Before the mission, he called his mother to tell his family not to worry about him.

Zhang Xiaofeng said that although five comrades-in-arms left, their heroic feats are inspiring the officers and men of the whole regiment to fight hard in the front line of earthquake relief. As of June 5, 1,799 emergency flights have been made, 1,121 wounded people have been successfully transported, 615 tons of urgently needed materials have been transported, and 2,171 trapped people have been transported, ensuring that the heads of the Central Committee and the Military Commission have inspected the disaster areas for 16 times, creating a record of super-intensity and super-meteorological flights in the history of Chinese military aviation.

Zhang Xiaofeng expressed his determination to follow the example of brave and fearless comrades-in-arms, live up to the great trust of the Party and the people, live up to the high hopes of the people in the disaster areas, and continue to fly with his life in order to win an all-round victory in earthquake relief!

Editor: Wang Chao